|

|

|

The textual material on this webpage is drawn directly from my work

America – The Covenant Nation © 2021, Volume One, pages 504-506.

|

At first, as the 20s come

to a close, it appears that the material "Good Times"

America was experiencing

was destined to last forever

President Herbert Hoover,

Henry Ford, Thomas Edison, and Harvey Firestone

at Edison's 82nd birthday.

Ft. Myers, Florida, February 11, 1929

... then things started going wrong

|

The stock market crash

Suddenly, without any apparent warning, the fun in urban America stopped abruptly toward the end of October 1929 when the great Wall Street Stock Market came crashing down – and with it the fortunes of countless Americans (and ultimately also Europeans). Overnight the boisterous optimism of industrial America turned into fear and panic – and then sad resignation as the national economy at the beginning of the 1930s collapsed into a long and deep Depression. Consumer frenzy in the world of capitalism

During the 1920s businesses that made radios, vacuum sweepers, washing machines, cars, etc. reaped huge fortunes from the sale of these goods to eager American buyers or consumers who wanted to have the latest new thing that came onto the market. Such ownership signified arrival at the good life. Thus the markets for such goods were hot, driven by consumer desires to own all these new things. And so consumers bought these things – in droves. And thus also the businesses that made them were busy. And workers had jobs. Companies were making great profits. Investors were getting fine dividends on their investments in these companies. And everyone was happy. In the capitalist system, the profits

made by these companies (the profits anyway that were not plowed back

into production expansion of the companies) were distributed as

dividends to the owners of the company in accordance with the number of

stocks or shares of the company that an investor owned. You bought

these stocks or shares on the open stock market (Wall Street's stock

market being a favorite). Anyone with money could buy a share or two,

or twenty, or a hundred or many hundreds, depending on how much money

you had to invest in these stocks. Speculative fever

Thus throughout the 1920s, the stock markets were busy buying and trading shares as people everywhere wanted to get in on the profits. People started frantically bidding higher and higher prices for each of those stocks or shares – not for the size of the dividends they would receive as shareholders, which in terms of what they now had to pay for a share was minuscule, but because they figured that they could turn around in short order and sell these shares on the fast-rising stock exchange or stock market to someone else for far more than they had paid for them, pocketing a huge profit in the exchange. This is called speculation. Toward the end of the 1920s speculation fever was running hot. People cashed in their life savings to get into the stock market. They even borrowed huge amounts from banks on margin (just putting up themselves personally a small percentage of the money needed to buy these stocks and borrowing the rest of the needed money from banks) so that these mom and pop investors found themselves deeply in debt. But they all figured, oh why not? ... I can turn around and sell these stocks in a few months for much more than I paid for them. I can pay back the bank, and pocket the large amount still remaining. That was a marvelous idea – as long as the speculative fever continued to drive stock prices up at this continuing frenetic rate. Market saturation

But toward the end of the 1920s, the economic picture in American industry was beginning to change. People were still buying radios, home appliances, cars – though not at the same rate as in the early and mid-1920s, because most of the people in a position to buy these things (the urban middle class) possessed most of these things by the late 1920s. There were fewer new purchasers of these goods coming into the economic marketplace. As a result, sales slowed down. Profits declined, production slowed, and workers were let go in small numbers. And the bloom on the economic picture faded a bit. The crash itself

The smart money boys decided it was time to sell their stocks. Moms and pops were still rushing to get into the market. But the big money boys were becoming cautious. Then other investors started to take notice of what the smart money was doing, and began to step back. Quickly rumors of the step back began to spread and uneasiness set in as people became less confident that the easy money was going to continue. Concern resulted – especially because many people were heavily indebted to the banks and a slowing stock market could mean trouble for them. As people started to sell stocks, they were willing to do so at a lower price, just to get out. Soon prices started to drop rather seriously. By the end of October of 1929, they were dropping precipitously. Suddenly people who just a month or two before were incredibly rich now found themselves in such massive debt that they were not now just poor. They were totally bankrupt.1 The sobering effect of the crash

What a tragic end to a decade that started out with such material promise (at least in the cities). But such tragedy would have a wonderfully disciplining effect on Americans as they faced a new decade (the 1930s) which required of them morally and spiritually much greater effort than they had employed during the Roaring Twenties. It was just as well, because Americans were going to have to be much leaner and hungrier than they were in the 1920s in order to face successfully the challenges to their civilization that events of the thirties (the Great Depression) and first half of the forties (World War Two) would throw in front of them. 1Actually,

the Stock Market decline would continue all the way downward into the

early 1930s. The Dow Jones Industrial Average (an index that measures

the level of general wealth of the world of corporate stocks) reached

its highest level in early September of 1929 at a little over 380

points. But by late October it had dropped to 230 points, having

dropped nearly 70 points on just the 28th and 29th of October (a loss

of around $30 billion in 1929 dollar value on just those two days

alone). By mid-November it dropped below 200 points – and then began a

slow rally, reaching a secondary peak of nearly 300 points in mid- April

of 1930. Then it began another slide the next year (1931) – reaching

its all-time low of a little over 40 points in July of 1932. It would

not recover its 1929 high until 1954.

|

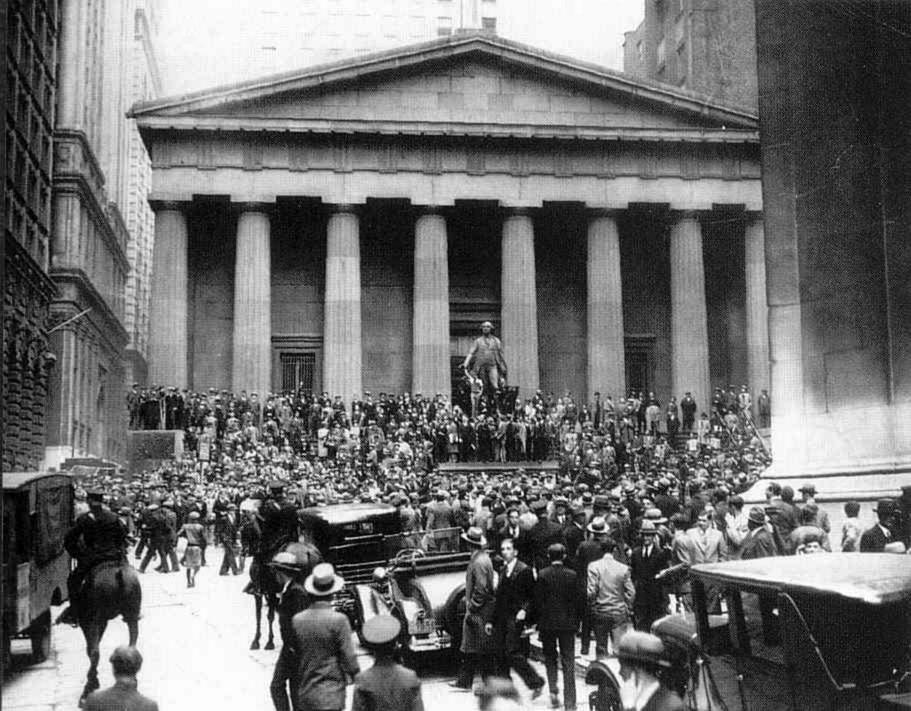

October 24, 1929 – Black

Thursday on Wall Street

A crowd gathers at New York

City's Federal Hall opposite the Stock Exchange

at the news of the crash

- 1929

Wall Street Stock Market Crash

Miles

H. Hodges

Miles

H. Hodges