|

|

Reagan's "Supply Side" economics versus Volcker's "Monetarism" Reagan's "Supply Side" economics versus Volcker's "Monetarism"

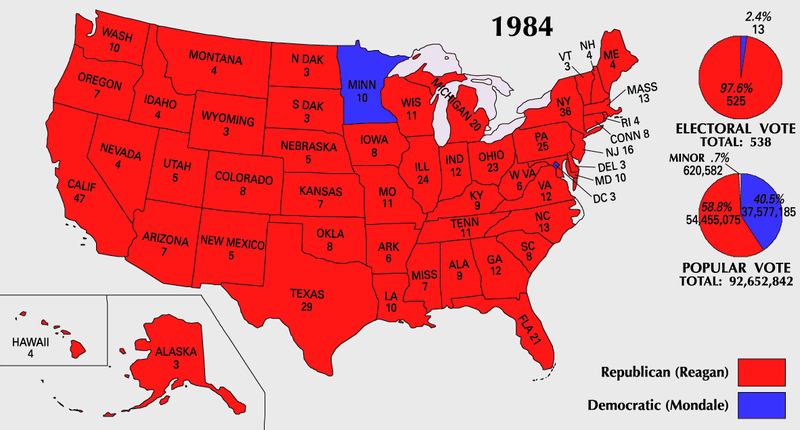

The 1984 presidential election The 1984 presidential electionThe textual material on this webpage is drawn directly from my work America – The Covenant Nation © 2021, Volume Two, pages 276-279. |

|

|

"Reaganomics" or "supply-side economics"

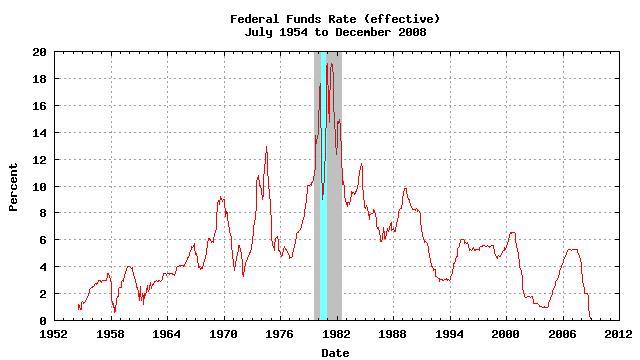

One of the terms that came into popular usage during Reagan's presidency in reference to his strategy for getting the economy up and running again was "Reaganomics." In general, it involved the idea of lowering taxes on businesses and individuals, reducing government spending (particularly in the area of the Democratic Party's social services programs), reducing government regulation (in everything from industry to finance), and tightening the money supply to reduce inflation. Sometimes Reaganomics was stated simply

as "supply side economics," meaning that the way to reduce inflation is

to reduce the price of goods and services by increasing the available

quantity of those goods and services. Classic market economics

understands that the more of something that you produce, the cheaper

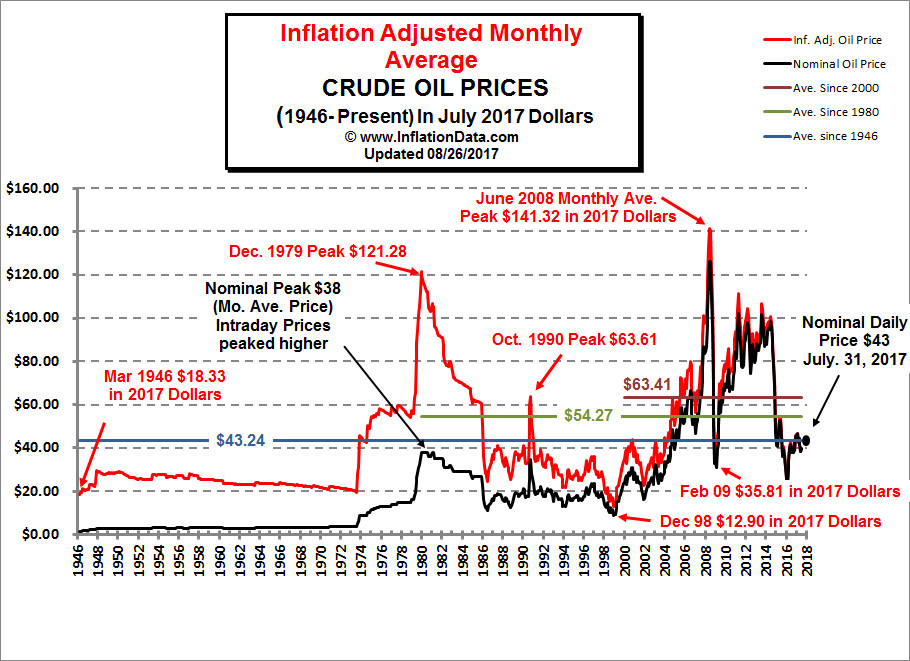

each unit will be.1 The problem with economics is that reality is much more complex than the mathematical models which economists produce in order to explain the economic behavior of a society. For this reason, economists rarely, if ever, agree among themselves in their explanations about what is going on with the economy. Was Reaganomics a success? Was it even effective? Did it do what Reagan wanted it to do? Were there other causes than the economic policies of the White House and Congress that truly accounted for the economic developments Americans saw going on? Etc., etc. The question of energy prices Certainly taxes were lowered. Certainly the economy picked up. Certainly also the federal deficit exploded from less than a trillion dollars at the beginning of the Reagan Administration to three times that amount by the end of his Administration eight years later. One of the big factors driving the huge inflationary rate that crippled America was the three-fold jump in the price of oil from 1979 to 1982. But just as the price of oil went up, so it also dropped away by 1982 with a huge oil glut. The price of oil started at the beginning of the 1970s at around $3 a barrel. As a result of the Arab oil embargo imposed in late 1973 to cripple the industrial West's support of Israel, the price of oil went quickly to almost four times that rate, delivering the industrial world its first oil shock of the 1970s. The price of oil through most of the rest of the 1970s hovered at the new rate of $12 a barrel. Then with the crisis in Iran in 1979 and the cutoff of Iranian oil sales to America, the price of oil immediately doubled, then continued to climb through the next year (1980) until it tripled ($36 a barrel), and then fixed itself at $32 a barrel. This tripling of the oil prices forced producers to try to switch to alternative fuels, which was a costly transition, and which also drove up the market prices of these alternative energy sources. All of this sent a shiver through the Western industrial world. To recover the expanded costs of energy, producers of industrial products were forced to raise their prices and reduce other costs (such as labor). Many businesses simply folded. Volcker's monetarism vs. Reagan's supply-side economics What is surprising is how long it took Reagan to realize that he and Federal Reserve President Volcker were working hugely at cross purposes. Volcker was trying to kill inflation by slowing down the economy by way of a strategy of very, very high interest rates, whereas Reagan was trying to fight inflation by increasing the supply of goods, thus bringing the price of things back down. But Reagan's increase in production would require a lowering of the interest rate so as to coax producers back into business. Congress finally caught on and forced Volcker to bring down interest rates, threatening to reduce the power of his Federal Reserve Board if he did not cooperate. The big man (he was 6'7") finally was forced to back down as America's financial "savior" (as he saw himself – or sometimes "czar" as others saw him), and do Congress's bidding. And indeed the economy finally began to pick back up again. The Soviets bring down the price of oil

This reduction in interest rates was timed with another major event occurring simultaneously in the Soviet Union. The Soviet economy was in trouble, short of the hard-currency (such as the dollar) needed to move the Soviet's international trade and economy in the direction of the worker's personal or consumer interests. And so the Russians (possessed of a huge number of rich oil fields) lowered the price of Soviet oil to attract customers – forcing other oil producers to have to do the same in order to keep their customers coming. But the Soviets were desperate for customers, so they lowered their oil prices even further, and soon an oil war was on, step by step bringing the price of oil way back down again, falling even to below $10 a barrel in 1986. Western industry was quick to respond positively to this cheaper source of energy, and found itself back in business again, able now to operate profitably (finally, lower interest rates and now also sources of cheaper energy). The status of Social Security A big problem inherited from the 1970s concerned the status of the Social Security program. Inflation in the 1970s had severely depleted the reserves of the Trust Fund because of the large jump in the cost of living allowance (COLA) which automatically adjusted payments to keep up with inflation. In 1977 the salary withholding tax for Social Security was increased from 2 percent to 6.15 percent, which put new life into Social Security, though only temporarily. As the economy plunged during the 1979-1982 recession, revenues were way down – so far down, in fact, that it looked in 1982 as if the Social Security Trust Fund would run out of money by 1983. As a result, Social Security taxing was increased along several fronts and the COLA was delayed and rescheduled, in order to put funding back in place. In 1983 Social Security was separated once again from the general fund in order to stand it apart as a separate budget item. However, provision was made for the Trust Fund to help the general fund meet deficit financing. It is important to note that when the government overspends, it still has to get the money from somewhere, usually U.S. government bondholders: citizens, banks at home and abroad, even foreign citizens and foreign governmental investors. One of the places that the government could get such supportive financing was the newly growing Social Security Trust Fund. The government would "borrow" from the Trust Fund to help finance the deficit, treating the Fund as if it were an independent bank or investor, extending to this funding source "IOUs" in the form of government bonds. In other words, Social Security would hold U.S. bonds, to be repayable (with interest) in the future, something like an "investment" for Social Security. Instead of Social Security simply sitting on a lot of money from tax revenues, it would put that money to work by "investing" in the government bonds that the U.S. government needed to sell in order to cover the costs of its deficits. In short, the Trust Fund would not be holding cash, but a large number of government IOUs There was much debate about the wisdom of this program. If the federal government ever defaulted on its loans, then the Trust Fund would be holding instead of cash only greatly devalued IOUs, worth only a small portion of their face value. Thus governmental bankruptcy would also bring down the U.S. Social Security system. Others claim that thinking that the U.S. government would ever have to default on its loans (deficit obligations) is nonsense. The U.S. government is one of the soundest financially in the world. Anyway, that seemed to be a reasonable argument back in the 1980s. Today, it is not such a sure bet. Governments have a funny way of suddenly and unexpectedly bellying up economically, as Soviet Russia was soon to demonstrate. 1Sadly,

farmers understand this principle very well. In years of great grain

harvests, the price they get for each bushel of their grain drops away

to a small percentage of what they were hoping to get.

|

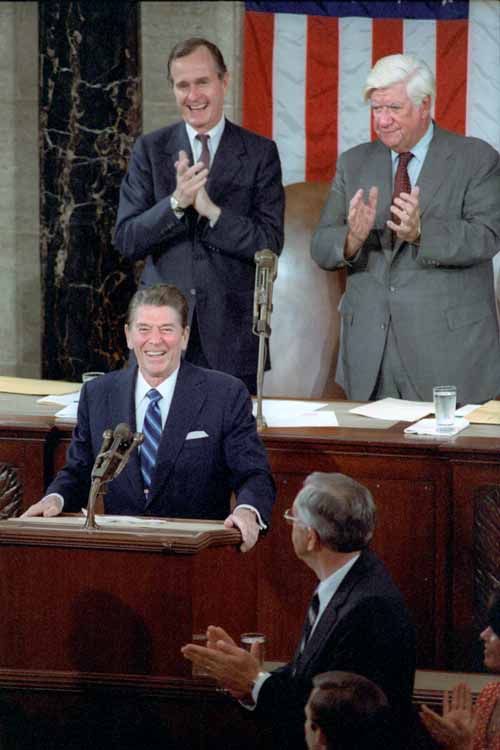

President Reagan addresses

Congress and the Nation from the U.S.

Capitol

concerning the Program for Economic Recovery

(his first speech after the

assassination attempt), April 28, 1981

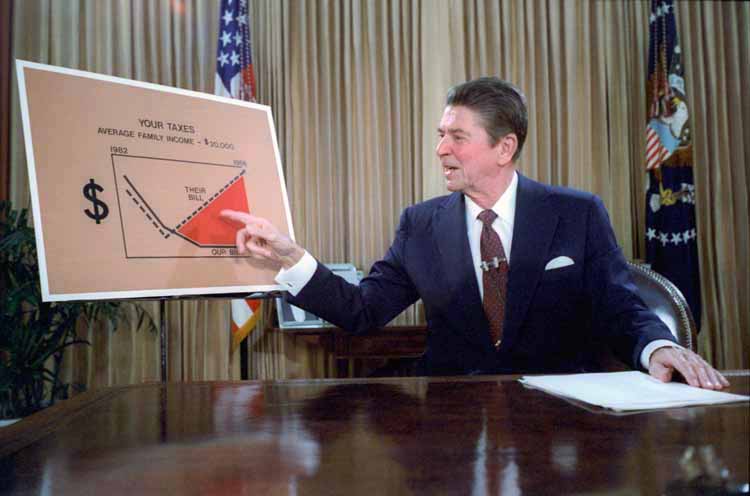

Reagan gives a televised

address from the Oval Office,

outlining his plan for Tax Reduction Legislation

in July 1981

President Reagan consulting

with Congressional Leaders

|

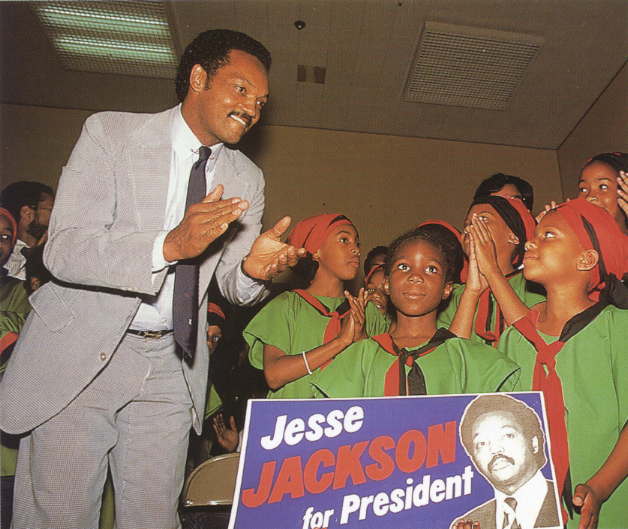

Jesse Jackson – in the Presidential

run in 1984

Walter Mondale – Democratic

Presidential candidate in the 1984 race

The Reagan-Mondale televised

debates – 1984

Reagan being sworn in for

his second term in the rotunda of the US Capitol – January 1985

Miles

H. Hodges

Miles

H. Hodges